In a world where seamless financial transactions and secure investments are paramount, Accrue emerges as a game-changing mobile app designed to streamline cross-border payments and revolutionize investment opportunities across Africa. With its user-friendly interface and a host of innovative features, Accrue has swiftly positioned itself as a reliable and efficient financial tool for individuals and businesses alike.

Let’s delve into the comprehensive review of Accrue and explore its standout features and benefits.

What is Accrue?

Accrue is a fintech mobile app that helps you Send money across Africa in 5 minutes. This is as easy, cheap, and fast as cross-border payments. With Accrue, you can send and receive money across Africa, in minutes. You can create virtual USD cards and fund them with MoMo, MPESA, bank transfer, or stablecoins. You can save in dollars (stablecoins) and earn up to 5% annual interest. You can also auto-invest in the top-performing stocks and cryptocurrencies with minimal risk and likelier profit.

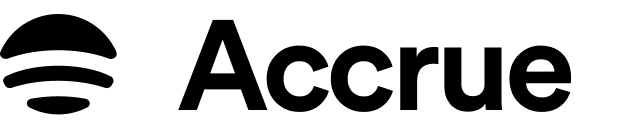

Effortless Cross-Border Payments

Accrue simplifies the complexities of cross-border transactions, allowing users to send and receive money across Africa within minutes. With a hassle-free process that is both affordable and swift, Accrue stands out as an invaluable solution for individuals and businesses operating within the African continent. The ability to create virtual USD cards and fund them through various channels such as MoMo, MPESA, bank transfers, or stablecoins amplifies the accessibility and convenience of cross-border payments, eliminating traditional barriers and inefficiencies.

Stablecoin Savings and Interest Earnings

One of the standout features of Accrue is its emphasis on providing users with a stablecoin (USD) savings account, enabling them to earn significant interest daily. By facilitating savings in a stable currency, Accrue safeguards users against the erosive impact of local currency fluctuations, ensuring a reliable means of preserving and growing wealth. The absence of fees or lock-up periods in the savings pocket further enhances the attractiveness of this feature, promoting financial inclusivity and encouraging a culture of prudent saving among users.

Diverse Investment Opportunities

Accrue goes beyond traditional banking services, empowering users to venture into the world of investments with ease and confidence. The app’s integration of top-performing stocks and cryptocurrencies presents a dynamic opportunity for individuals to diversify their investment portfolios directly from their mobile phones.

The option for auto-investing using dollar-cost-averaging strategies, combined with the ability to create custom triggers and actions through Playbooks, amplifies the accessibility of investment opportunities while mitigating risks and ensuring a seamless user experience.

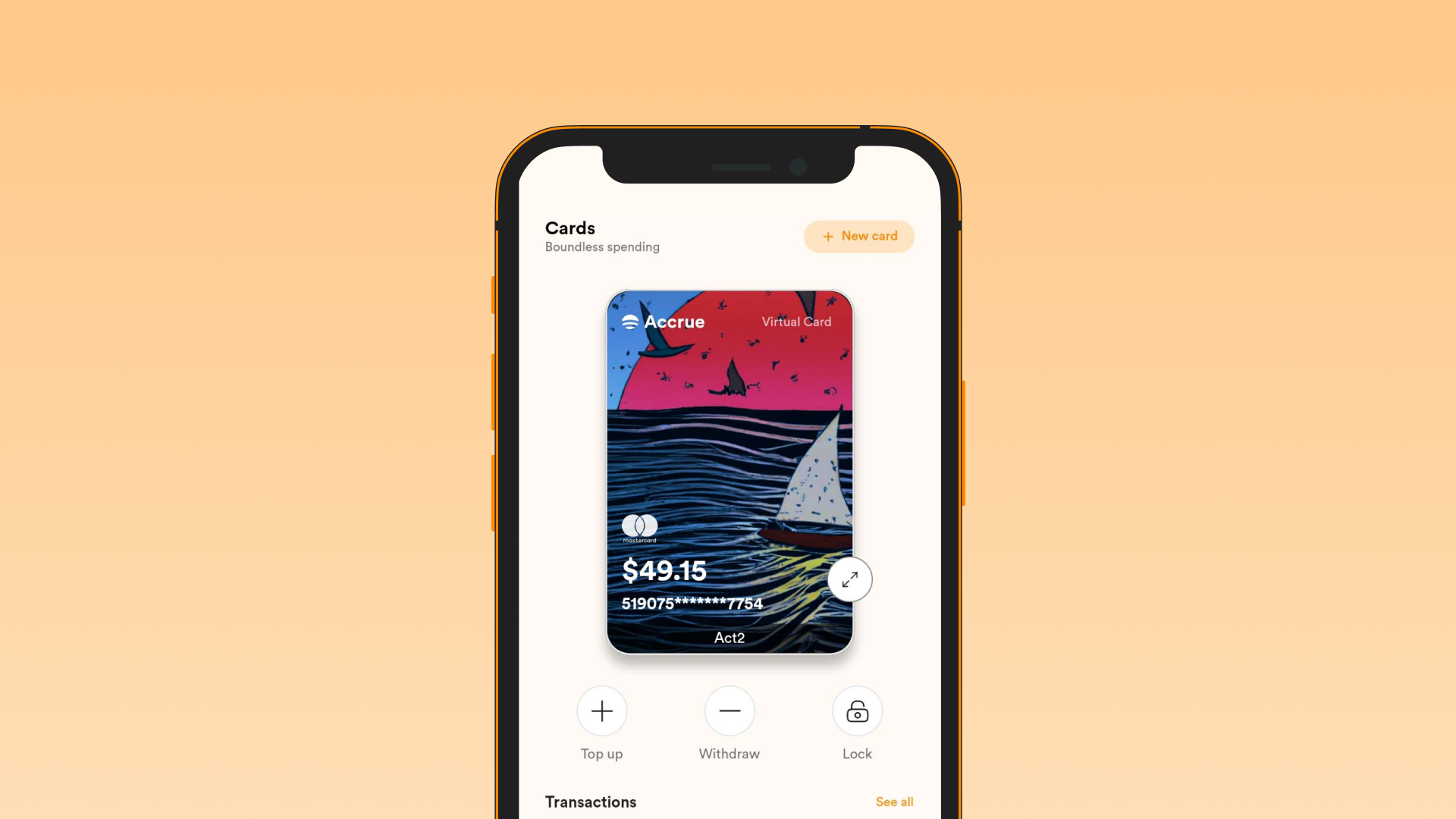

Secure and Boundless Spending

Accrue’s provision of virtual USD cards enables users to conduct transactions securely and seamlessly across various platforms that accept Mastercard and Visa debit cards. This feature liberates users from the constraints of geographical boundaries, facilitating boundless spending and amplifying the convenience of financial transactions in an increasingly interconnected global economy.

Conclusion

Accrue stands as a beacon of financial empowerment, offering a comprehensive suite of services that cater to the diverse needs of individuals and businesses across Africa.

From facilitating cross-border payments to providing stablecoin savings accounts and enabling hassle-free investments, Accrue has positioned itself as a pioneering force in reshaping the financial landscape of the continent.

With its emphasis on accessibility, security, and innovative financial solutions, Accrue is set to redefine the way individuals and businesses engage with their finances in an increasingly interconnected world.

Pingback: Chipper Cash Review: The All-in-One Money Transfer and Investment Platform